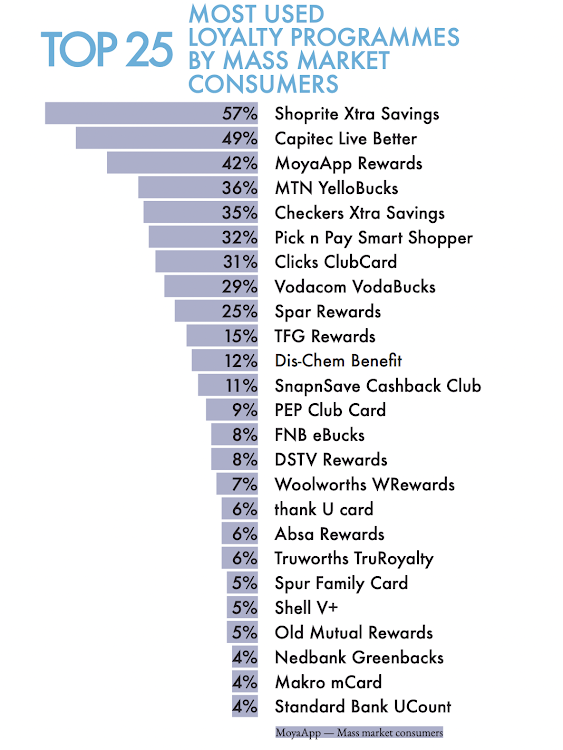

These are South Africa’s most popular loyalty programmes

By: Lynette Dicey - BusinessLive

Loyalty programme usage in South Africa has grown from 67% in 2015 to 76% in 2023/2024 across both gender and income categories, says the most recent “South African Loyalty Landscape Whitepaper” by Truth & BrandMapp.

For the first time in the almost 10 years of loyalty programme usage being tracked, the percentage of male and female users is the same. But only 55% of economically active under 25s are using loyalty programmes, and among those in that age group who are less wealthy 72% use them.

The report ranks Checkers Xtra Savings as the most used loyalty programme of wealthier consumers, slightly ahead of the Clicks ClubCard. Shoprite Xtra Savings is the most used programme of mass market consumers, followed by Capitec Live Better.

The research shows that getting cash back remains the preferred benefit of economically active consumers. Mass market consumers also value cashback, but prefer airtime or data. Local consumers are not alone in their preference for cashback rewards; a recent poll by Annex Cloud shows that 46% of its global followers prefer cashback incentives and 36% like points-based programmes better.

Some consumers prefer to build up rewards; others like instant gratification. However, the report says 47% of the latter group prefer to do both. These are the most savvy and demanding loyalty members.

In a tough economic climate, consumers are using loyalty programmes more than they did last year. The report points out that the more consumers invest in the programmes they really benefit from, the greater the reward potential of the programmes. Wealthier consumers use almost double the number of loyalty programmes of mass market consumers.

The three biggest motivations for economically active consumers to engage with loyalty programmes are being instantly rewarded (45%), building up points for big rewards (41%) and spending more to earn more rewards (35%).

In the mass market, the three biggest motivators are to earn more rewards (61%), to build up points for big rewards (48%) and to avoid points expiring before they can be used (33%).

Programme tiers don’t feature significantly in anybody’s motivation for using loyalty programmes

“If there is one way to upset any loyalty member it is to let their points expire before they wish to use them ... programme managers need to understand who their consumers are before introducing an expiry rule which could seriously upset their most loyal customers,” says Whitepaper author Amanda Cromhout, founder and CEO of Truth, a Cape Town-based loyalty consultancy.

Truth recommends allowing active members to build up points should they wish to, or to redeem them immediately as long as they are active. “‘Active’ can be defined as any period of time that makes sense for the loyalty brand. Typically, retailers look at a 12-month period (but this can vary from a grocery retailer. with a higher frequency. and a furniture or general merchandise retailer, with a lower frequency),” says Cromhout.

Interestingly, programme tiers don’t feature significantly in anybody’s motivation for using loyalty programmes.

Among economically active users, loyalty programmes influence where they get groceries (78%), fuel (55%), bank services (48%), health products and pharmaceuticals (35%) and clothes (33%), as well as which restaurants and coffee shops they use (27%).

Among mass market consumers, loyalty programmes influence where they shop for groceries (71%), banking services (51%), clothes (35%) and health products and pharmaceuticals (29%), as well as the restaurants and coffee shops they visit (18%).

If consumers had to choose just one programme they couldn’t live without, it is Discovery Vitality for economically active consumers and Capitec Live Better for mass market consumers.

News Category

- International retailers

- On the move

- Awards and achievements

- Legislation

- Wine and liquor

- Africa

- Going green

- Supplier news

- Research tools

- Retailer trading results

- Supply chain

- Innovation and technology

- Economic factors

- Crime and security

- Store Openings

- Marketing and Promotions

- Social Responsibility

- Brand Press Office

Related Articles

More Pick n Pay smart shoppers switching points...

Mr D versus Checkers Sixty60, Woolies Dash, Ube...

New Research Finds 84% of South Africans Demand...

Take heed of these new retail trends that emerg...