Mr D versus Checkers Sixty60, Woolies Dash, Uber Eats, and Pick n Pay ASAP – Price showdown

By: Staff Writer - MyBroadBand

Mr D Groceries has partnered with Pick n Pay stores across South Africa to give shoppers access to more than 27,000 food products at in-store prices – including drinks, meat, snacks, fresh produce, and more.

As part of the partnership, Mr D makes several promises to its users when they shop through the app.

Firstly, Mr D Groceries has stated the prices you see in-store at a Pick n Pay are the prices you will pay on the Mr D app, and you can earn all the same Smart Shopper and Vitality points you would earn in-store.

As a result, Mr D Groceries offers some of the best pricing in the country when it comes to online grocery shopping.

Secondly, when you place your Pick n Pay order through the Mr D app, you can expect to receive your groceries in under an hour.

This is thanks to Mr D’s world-class logistics and delivery services, which have been built over many years.

To test whether Mr D can deliver upon these promises, MyBroadband put the service to the test.

Mr D tested

MyBroadband tested the Mr D app’s delivery times when it first launched a partnership pilot programme with Pick n Pay in 2022, and we found them to be excellent.

From placing an order to having it delivered to our door took 20 minutes – which was very impressive.

This puts it in line with other top players in the on-demand online shopping space, including Checkers Sixty60, Woolies Dash, Uber Eats, and Pick n Pay ASAP.

With all of these services on a similar footing when it comes to delivery times, the deciding factor for many shoppers then becomes price.

To see how they stack up, we compared a basket of popular food products from Mr D Groceries and Pick n Pay against the same basket from Checkers Sixty60, Woolies Dash, Uber Eats, and Pick n Pay ASAP.

Where possible, we used identical products. Where identical products were unavailable, we used comparable products offered by each retailer.

The results are detailed in the table below. All purchases were made from the same location, and prices were accurate as of 15 March 2024.

|

Product |

Pick n Pay – Mr D Groceries |

Pick n Pay – Pick n Pay ASAP |

Checkers Groceries – Sixty60 |

Woolworths Groceries – Woolies Dash |

Uber Eats Market – Uber Eats |

|

Full Cream Fresh Milk (2 litre) |

R34.99 |

R34.99 |

R34.99 |

R38.99 |

R44.99 |

|

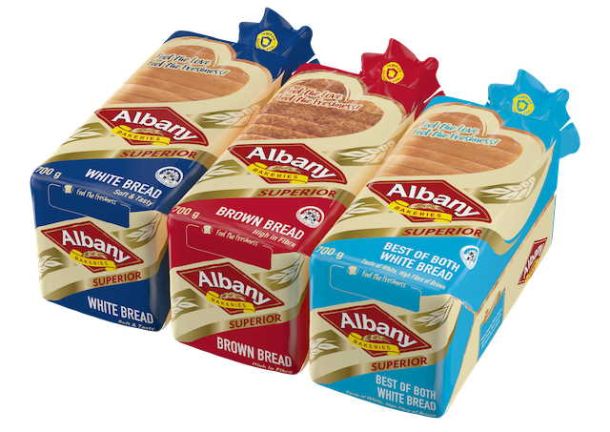

Best of Both / High Fibre Bread (700g) |

R22.99 |

R22.99 |

R22.99 |

R23.99 |

R21.99 |

|

Maize meal (2.5kg) |

R41.49 |

R41.49 |

R39.99 |

R41.99 |

R39.99 |

|

2-minute Noodles (5 x 68g) |

R36.99 |

R36.99 |

R38.99 |

R45.00 |

R49.99 |

|

Oats (1kg) |

R34.99 |

R34.99 |

R34.99 |

R43.99 |

R72.99 |

|

Rooibos Teabags (80s) |

R49.99 |

R49.99 |

R49.99 |

R49.99 |

R86.76 (20s x 4) |

|

Coca-Cola 2L Bottle |

R25.99 |

R25.99 |

R26.99 |

R26.99 |

R45.98 (1L x 2) |

|

Oros Original Orange Squash (2 litre) |

R47.99 |

R47.99 |

R47.99 |

R46.99 |

R57.98 (1L x 2) |

|

Delivery Fee |

R35.00 |

R35.00 |

R35.00 |

R35.00 |

R38.03 (R17 + 5% of order) |

|

Total |

R330.42 |

R330.42 |

R331.92 |

R352.93 |

R458.70 |

We found that most products were cheapest when shopping at Pick n Pay – whether through Mr D Groceries or Pick n Pay ASAP.

The identical pricing between the Mr D Groceries and Pick n Pay ASAP apps is logical, as both apps state that they use in-store Pick n Pay pricing on their apps.

Other notable findings included that the Uber Eats Market was often missing popular products in certain quantities that were readily available through the other apps.

This forced us to buy multiple of a smaller quantity to make up the equivalent quantity, and this resulted in more expensive purchases – something that Uber Eats customers would also experience.

Furthermore, Woolworths regularly had more expensive pricing than the Pick n Pay and Checkers options.

This was primarily due to its preference for selling its own, more expensive brand for many of its products, without offering many comparable alternatives.

News Category

- International retailers

- On the move

- Awards and achievements

- Legislation

- Wine and liquor

- Africa

- Going green

- Supplier news

- Research tools

- Retailer trading results

- Supply chain

- Innovation and technology

- Economic factors

- Crime and security

- Store Openings

- Marketing and Promotions

- Social Responsibility

- Brand Press Office

Related Articles

More Pick n Pay smart shoppers switching points...

These are South Africa’s most popular loyalty p...

New Research Finds 84% of South Africans Demand...

Take heed of these new retail trends that emerg...